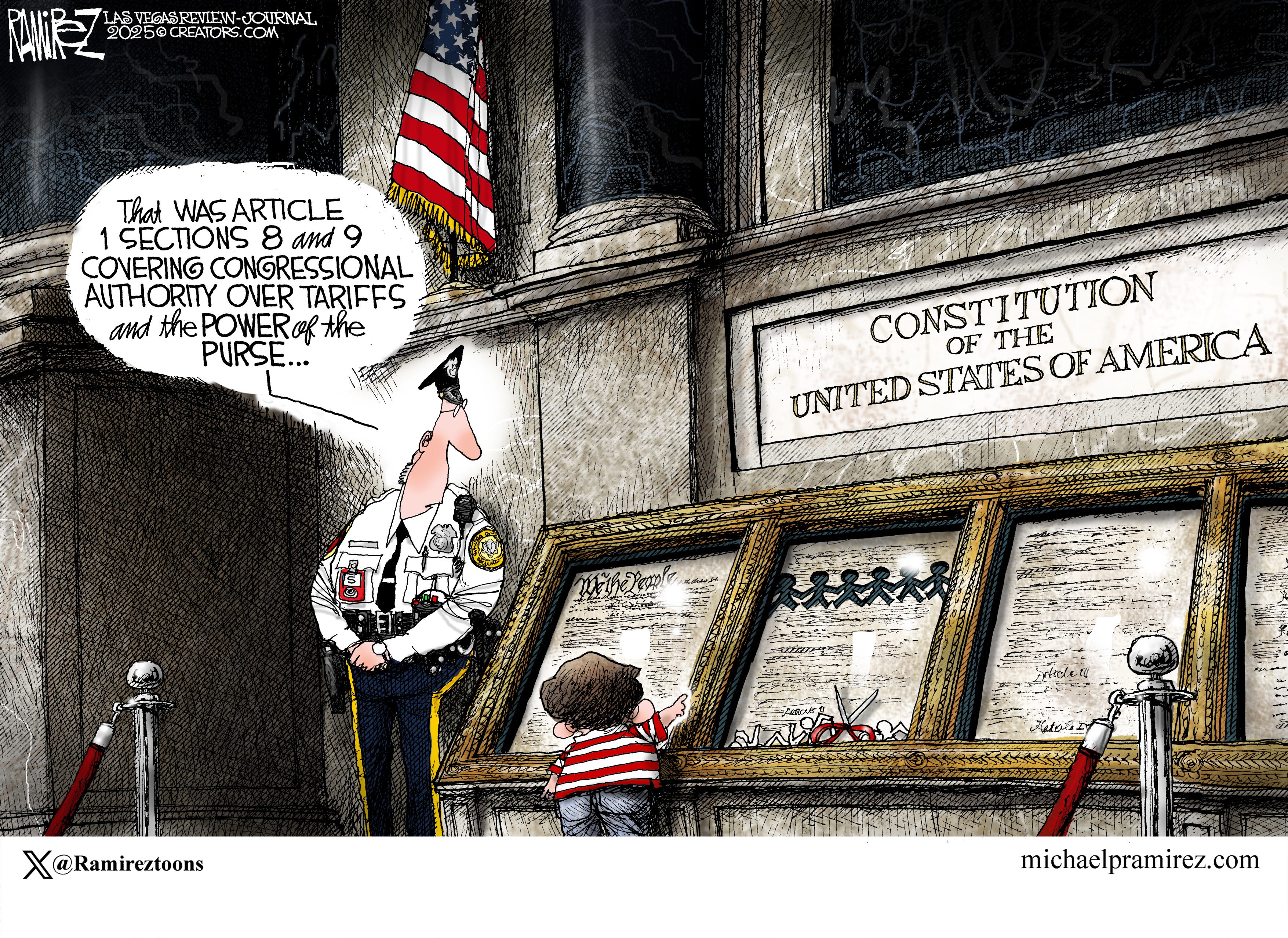

Believe it or don't, I saw that Michael Ramirez cartoon only a few minutes after I read this Ars Technica article: Coding error blamed after parts of Constitution disappear from US website.

The Library of Congress today said a coding error resulted in the deletion of parts of the US Constitution from Congress' website and promised a fix after many Internet users pointed out the missing sections this morning.

"It has been brought to our attention that some sections of Article 1 are missing from the Constitution Annotated (constitution.congress.gov) website," the Library of Congress said today. "We've learned that this is due to a coding error. We have been working to correct this and expect it to be resolved soon."

And (sure enough) the "disappeared" bits included "part of" Article I, Section 8. Also "the section on habeas corpus".

But I'm sure that's just a coincidence.

Also of note:

-

Vlad, when you've lost Trump… George Will notes that The epically blundering Putin is alienating even Trump. (WaPo gifted link)

President Donald Trump has announced himself “disappointed.” He had such high hopes for Vladimir Putin.

Putin’s response to Trump’s 50-day ultimatum — to agree to “a deal” by Sept. 3 or face severe economic consequences — was intensified attacks on Ukraine’s population centers. Trump’s subsequent 10-day ultimatum, expiring Friday, seems to have been equally unavailing. Putin aims to get not to negotiations but to Kyiv, because only extinguishing Ukraine’s nationhood can redeem his epochal blunder.

Although Putin has been certified a “genius” (by Trump; Putin has not reciprocated), not since Adolf Hitler invaded the Soviet Union 84 summers ago has a military undertaking been as comprehensively counterproductive for its initiator as Putin’s invasion of Ukraine.

As GFW notes, Trump's "deadline" expires tomorrow, and here's hoping it won't be another TACO Friday.

-

A big dose of reality. Kevin D. Williamson is (as usual) out of patience with the folks trying to resuscitate a long-dead horse: Moving Beyond the Two-State Solution.

About two years ago, I had a conversation with a gentleman who has served at the highest levels of the U.S. defense and intelligence apparatus. He spoke of the necessity of a continued U.S. commitment to the so-called two-state solution in Israel and the Palestinian territories—“so-called,” I write, because there are not two states, and because there are not going to be two states, and because it is not a solution. (Other than that … ) I asked him what seemed and seems to me to be the obvious question: How do we expect to have two states when the undeniable and repeatedly demonstrated fact of the matter is that Palestinian sovereignty and Israeli security are incompatible?

“We can’t let that be the case,” he non-answered. “There is no alternative.”

The two-state solution calls to mind many similar regional phantoms, the will-o’-the-wisps of Middle Eastern discourse, e.g., a nuclear deal that the Iranians will honor. Why have an Iranian nuclear deal? Because the alternative is not having an Iranian nuclear deal, which apparently is unthinkable. (Or was, until somebody thought of something better.) Why commit ourselves to a two-state solution for the Palestinians? Because we must, because TINA says so. You know TINA: “There Is No Alternative,” a declaration that seems to be invested with magical powers in the minds of people who cannot accept that some problems are practically irresolvable.

But there is an alternative, the one nobody likes but the one we are likely to have for a long time: the status quo.

KDW's Dispatch article is a "counterpoint" to John Aziz's "point" article: Palestinian Statehood Is the Only Answer. I find (unsurprisingly) KDW to be more attached to reality, but (as I know I don't need to tell you) see what you think.

-

"The answer may surprise you." Yes, that's the subhed on David R. Henderson's EconLog post: Who Got the Biggest Percentage Tax Cuts?

In so much of the discussion of tax cuts, whether of the recent one or previous tax cuts, we hear that the highest-income people got the biggest tax cuts. Of course, they did. They pay a disproportionately high percent of overall federal taxes. So it shouldn’t be surprising that they get the biggest tax cuts in absolute terms.

But that doesn’t mean that the highest-income people got the highest percentage tax cut. Reporters have generally not done a good job of making that point.

For the answer, David turns to a recent WSJ article, which reveals (ta da!): Here Are the Winners From Trump’s Tax Law (WSJ gifted link)

And in those percentage terms:

The average change in federal taxes paid in 2026, due to the new tax law will be:

-15.1% for the lowest quintile

-14.9% for the second quintile

-12.6% for the middle quintile

-11.1% for the fourth quintile

-9.2% for the 80-90 percentile

-9.5% for the 90-95 percentile

-11.2% for the 95-99 percentile

-7.1% for the top 1%.

Which causes me to embed this silly (but catchy) (and also relevant) SNL snippet:

![[The Blogger]](/ps/images/barred.jpg)